Friday, July 26, 2024

Friday, July 26, 2024  Friday, July 26, 2024

Friday, July 26, 2024

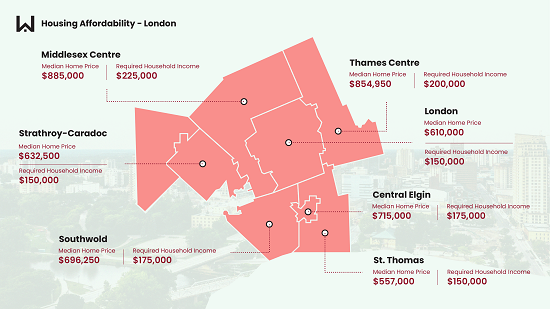

New analysis by digital real estate platform Wahi shows how the London area ranks for affordability compared to the rest of Ontario.

In the London area, households may need to earn as much as $225,000 a year to afford a home, depending on which area they’re looking at. That’s more than a household would need to purchase a dwelling in Old Toronto, the city of Ottawa, or many other larger urban centres across the province.

The finding is from the recently released Ontario edition of Wahi’s Roadmap to Housing Affordability, an interactive tool that lets homebuyers see where they may — or may not — be able to afford a home, based on their earnings and local home prices. In all, Wahi analyzed 245 local housing markets across the province, including seven across the London census area.

| London Area Housing Market | Median Home Price | Required Household Income |

| Middlesex Centre | $885,000 | $225,000 |

| Thames Centre | $854,950 | $200,000 |

| Central Elgin | $715,000 | $175,000 |

| Southwold | $696,250 | $175,000 |

| Strathroy-Caradoc | $632,500 | $150,000 |

| London | $610,000 | $150,000 |

| St. Thomas | $557,000 | $150,000 |

To use Wahi’s Roadmap to Housing Affordability, homebuyers first enter their household income. The tool then populates a map that highlights local markets where the median home price (from the first quarter of the year) is affordable, based on a few assumptions. For instance, Wahi assumes a 20% downpayment, a mortgage rate of 5.24% (provided by Rocket Mortgage as of July 14), and a 25-year amortization period. To meet the affordability threshold, households shouldn’t be spending more than 25% of their pre-tax income on monthly mortgage payments.

“Wahi’s Roadmap to Housing Affordability highlights the challenges facing many households throughout the province, but it also gives first-time homebuyers valuable insights into places where home prices are more affordable,” says Wahi CEO Benjy Katchen. “The tool helps Ontarians understand what kind of income they’ll need depending on where they want to live.”

To afford Middlesex Centre’s median home price of $885,000 — the most expensive in the London area — households need to earn a combined income of $225,000. (Note this doesn’t include savings, help from relatives, or other factors that may help a household purchase a home.) This means that households in Middlesex Centre actually need to earn more than residents in Old Toronto, which includes the city’s downtown core and some of Toronto’s oldest neighbourhoods, to afford a local median-priced home. In Old Toronto, the median home price was $785,000 in the first quarter, requiring a household income of $200,000.

Affordability challenges in London have made headlines, and Wahi’s analysis confirms that none of the London Area’s local housing markets are affordable with an average Ontario household income, which is about $100,000. However, when looking at all local housing markets, those across the London Area are generally in the middle of the pack provincially. This is how they rank provincewide:

| London Area Housing Markets | Provincial Rank (out of 245) |

| St. Thomas | 60 |

| London | 93 |

| Strathroy Caradoc | 107 |

| Southwold | 144 |

| Central Elgin | 150 |

| Thames Centre | 198 |

| Middlesex Centre | 206 |

Just because the median home price is unattainable at a given income level, it doesn’t mean homebuyers should give up searching. Once you’ve determined your maximum budget by using the Roadmap to Housing Affordability, you can then scan Wahi listings to view properties at lower price points.

Other highlights:

Curious to see which parts of the province are within your homebuying budget? Check out Wahi’s Roadmap to Housing Affordability: Ontario Edition.