Monday, May 6, 2024

Monday, May 6, 2024  Monday, May 6, 2024

Monday, May 6, 2024

John Burns Research and Consulting and Home Innovation Research Labs recently released their inaugural Building Products Demand Meter. This industry-first data product tracks current and historical US residential installed product volumes (final demand) for major building product categories.

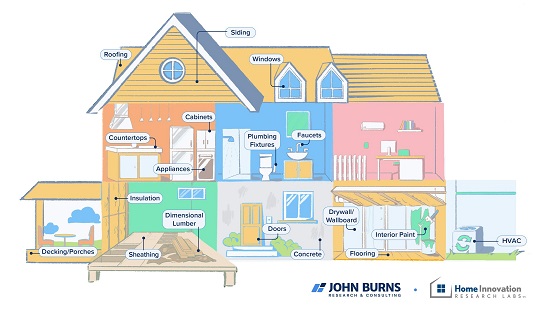

The Building Products Demand Meter measures installed residential market volumes across 18 major building product categories—from dimensional lumber and siding to HVAC and interior paint—back to 2000. It is available for both the new construction and repair and remodel segments of the US residential building products market (installed volumes and year-over-year growth rates).

“The building products industry has been asking for better data to make more informed decisions,” said Matt Saunders, SVP Building Products Research at John Burns Research and Consulting. “This groundbreaking new product addresses this need, combining our expertise in forecasting and analysis with Home Innovation’s industry-leading survey research. The Building Products Demand Meter provides market size and growth estimates at the category level for both new construction and repair and remodeling end markets.”

The data, scheduled for an update each quarter, is grounded in more than two decades of survey research conducted by Home Innovation in their Annual Builder Practices and Consumer Practices surveys. “The new Building Products Demand Meter combines the best of our longstanding survey research, JBREC’s best-in-class forecasting expertise, and our deep combined knowledge of home building and remodeling,” said Ed Hudson, Director of Market Research at Home Innovation.