Thursday, May 2, 2024

Thursday, May 2, 2024  Thursday, May 2, 2024

Thursday, May 2, 2024

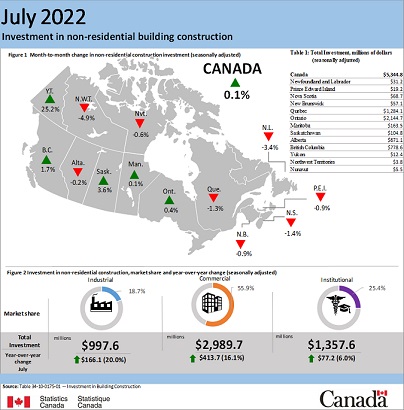

Statistics Canada reports that investment in building construction continued its upward trend since October 2021, rising 0.8% to $21.0 billion in July. Both the residential (+1.0% to $15.7 billion) and the non-residential sectors (+0.1% to $5.3 billion) showed increases.

On a constant dollar basis (2012=100), investment in building construction increased 1.4% to $12.8 billion.

Investment in non-residential construction nudged up 0.1% to $5.3 billion in July.

Commercial investment was up 0.6% to $3.0 billion for the month, cooling down after posting strong gains in June. Notable growth for the component mainly came from British Columbia (+3.5%), stemming from multiple projects across Vancouver.

At the subcomponent level, new construction for Trade and Services and Warehouses contributed the most to the growth. In July, construction in Trade and Services has surpassed pre-COVID-19 pandemic levels, with substantial growth over the previous 12 months. Warehouses have also seen considerable growth, with an increase of 42.0% on an unadjusted basis since March 2021, coinciding with a strong growth in e-commerce and the need for large e-commerce companies to store goods locally for rapid delivery. Conversely, investment in new office buildings, after a temporary bounce back in June 2020, has been on a downward trend ever since, as the work-from-home model became more prevalent and the number of unoccupied offices across Canada continued to increase.

Investment in the industrial component advanced 2.2% to $1.0 billion in July, with gains in seven provinces. Ontario accounted for most of the gains for the component in the month, continuing its considerable growth since December 2021.

Institutional construction investment declined 2.3% to $1.4 billion in July, the largest decline for the component since April 2020.

Investment in residential building construction advanced 1.0% to $15.7 billion in July.

Single-family home investment edged up 0.3% to $8.6 billion and has remained relatively stable over the five months ending in July.

Multi-unit construction investment increased 1.8% to $7.1 billion for the month, with apartment projects in Ontario and British Columbia contributing significantly to the gains.

On an unadjusted basis, new construction for both single-family homes and multi-unit construction have shown notable growth in the previous few months and are up 3.9% year over year in July.