Thursday, September 19, 2024

Thursday, September 19, 2024  Thursday, September 19, 2024

Thursday, September 19, 2024

According to the latest report from Statistics Canada, investment in building construction across the country decreased by 1.7% to $20.9 billion in July. This decline comes after consecutive increases of 0.7% in May and 2.7% in June. Despite the month-over-month drop, investment in building construction showed an annual growth of 7.0% in July.

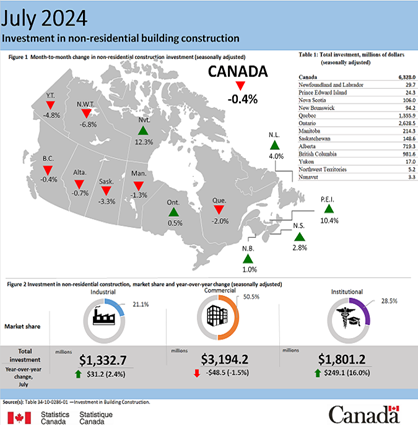

Both the residential and non-residential sectors experienced declines in July. Residential investment fell by 2.2%, amounting to $14.6 billion, while the non-residential sector saw a marginal decrease of 0.4%, totaling $6.3 billion.

When adjusted for inflation (using 2017 as the base year), the investment in building construction decreased by 1.9% from June, standing at $12.7 billion in July. However, a year-over-year analysis reveals a 3.9% increase.

Investment in residential building construction dropped by 2.2%, a decrease of $330 million, settling at $14.6 billion in July. The single-family home investment sector was notably impacted, shrinking by 2.2% ($148.9 million) to $6.7 billion. This decline was widespread, with 11 provinces and territories reporting reductions. Notably, only Saskatchewan (+$6.4 million) and Nunavut (+$1.2 million) recorded increases in single-family home investments.

The multi-unit construction sector also experienced a 2.2% decrease ($181.1 million), reaching $7.9 billion in July. This decline was mainly driven by Quebec, which saw a significant drop of $184.3 million, following robust growth in May (+$206.6 million) and June (+$282.6 million). Ontario, however, provided a slight buffer to this decline with a gain of $105.6 million.

Investment in the non-residential construction sector edged down by 0.4% to $6.3 billion in July. The industrial component marked its fourth consecutive monthly decline, falling by 2.1% ($28.2 million) to $1.3 billion. Quebec (-$13.1 million) and Ontario (-$12.0 million) were the primary contributors to this decline, with additional decreases observed in seven other provinces and all three territories. Alberta was the sole province to report an increase in industrial investment, with a gain of $2.0 million.

The commercial construction component also experienced a minor decrease of 0.4% ($11.7 million), amounting to $3.2 billion in July. Declines were noted in five provinces and two territories, led by Quebec (-$9.6 million) and Alberta (-$4.8 million). These decreases were partly mitigated by gains in six provinces and territories, with British Columbia seeing the most significant increase of $6.0 million.

The institutional construction component was the only area to record an increase in July, rising by 0.8% to reach $1.8 billion. This uptick suggests some positive momentum in this segment of the non-residential sector, contrasting with the overall downward trend in building construction investment for the month.

July’s decline in building construction investment in Canada, as reported by Statistics Canada, indicates a slowdown following growth in previous months. While both residential and non-residential sectors experienced decreases, specific areas like institutional construction showed resilience. The performance varied across provinces, with Quebec and Ontario playing significant roles in the overall numbers.

Industry professionals will be watching closely to see if this downturn continues in the coming months or if the market will rebound, particularly in the residential construction sector, which has shown considerable volatility.

Check out more news, articles and blogs here