Thursday, April 25, 2024

Thursday, April 25, 2024  Thursday, April 25, 2024

Thursday, April 25, 2024

In Spain, private sector credit as a share of GDP almost doubled between 2000 and 2007. This increase was accompanied by a boom in housing prices – which doubled in real terms over the same period. The economy as a whole also grew at a record pace.

But then in 2008, Spain’s credit bubble burst, and with it came loan defaults, bank failures, and a prolonged economic slowdown.

A less-noticed development in Spain was in the construction sector, where employment grew by an astounding 47 percent, compared to the economy-wide increase of 27 percent.

New IMF staff research, based on a large sample of advanced and emerging market economies since the 1970s, shows that long-lasting credit booms that featured rapid construction growth never ended well.

Rapid credit growth – known as “credit booms” – presents a trade-off between immediate, buoyant economic performance and the danger of a future crisis. The risk of a “bad boom”- where a rapid credit growth episode is followed by a financial crisis or subpar economic growth -increases when there is also a boom in house prices.

Our research shows that the experience with the dangerous combination of credit booms and rapid expansion in the construction sector goes beyond the Spanish borders and extends to time periods not related to the global financial crisis.

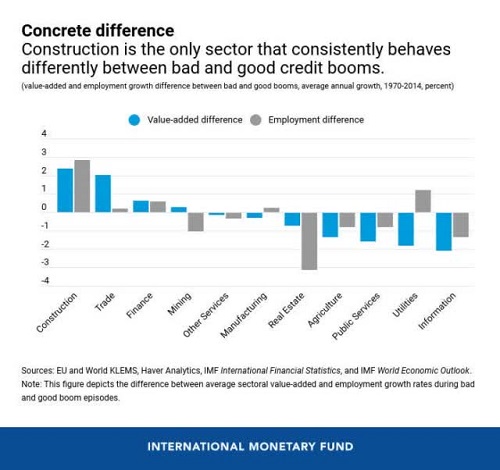

We find that signals from construction activity may help to tell apart the dangerous booms, which need to be controlled, from the episodes of buoyant but healthy credit growth (“good booms”).

During booms, output and employment expand faster. But not all sectors behave the same. Most of the extra growth is concentrated in a few industries – specifically, construction and, at a distant second, finance.

However, the same industries that benefit the most during booms experience the most severe downturns during busts. This implies that credit booms tend to leave few long-term footprints on a country’s industrial composition.

Keep reading on SeekingAlpha.com

The next publication deadline is Friday at noon

Join Construction Links Network