Monday, September 9, 2024

Monday, September 9, 2024  Monday, September 9, 2024

Monday, September 9, 2024

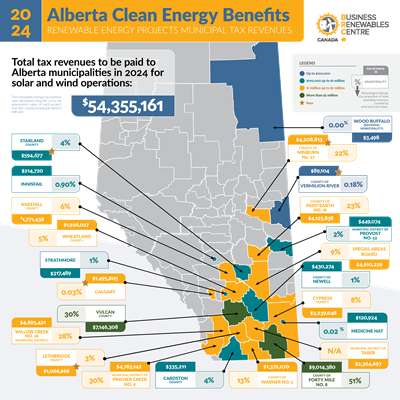

Alberta municipalities will collect almost twice as much in tax revenues from wind and solar projects in their jurisdictions this year compared to last year, according to new analysis by the Business Renewables Centre-Canada (BRC-Canada).

“Municipal tax revenues amounted to $54 million this year, up from $28 million last year,” said Jorden Dye, director of BRC-Canada. “This revenue is reliable, stable income that communities can plan around for decades to come.”

Fourteen Alberta communities are collecting over $1 million annually now in revenues, with seven of them hitting over $4 million. For five communities, this revenue makes up 20 to 30 per cent of their total operating revenues for the year, while one community hit 51 per cent.

All of these projects, though, were initiated, approved and constructed before the Alberta government announced its moratorium on renewable energy project approvals on August 3, 2023.

“Since the moratorium announcement, 53 projects have been cancelled,” said Dye. “We have conservatively calculated that this represents $91 million in lost annual tax revenues for municipalities. That’s almost double what Alberta communities are earning this year.”

When the Alberta government announced their moratorium it was under the headline, “Creating certainty for renewable projects.” But a year later, the clean energy industry continues to labour under confusing regulatory headwinds. The uncertainty has drained confidence and energy from Alberta’s market.

“The number of power purchase agreements (PPAs) by corporations looking to buy clean energy to fulfill their sustainability goals has plummeted,” said Dye. “The first half of 2024 has been the slowest for the Alberta PPA market since 2020, with only one deal announced so far.”

These PPAs have been an important support to clean energy development in Alberta over the last five years: between January 1, 2019, to December 31, 2023, 34 per cent of new installed generation was made possible by corporate renewable energy procurement.

The rate of project cancellations has also increased five-fold. Though there are usually one to five cancellations each quarter, the Alberta Electric System Operator has noted 53 cancellations so far since the moratorium was announced.

While it is true that several thousand megawatts worth of clean energy projects are currently proposed for Alberta, that has long been the case. Obviously, not all projects proceed.

“It is our observation that the cancellation rate is what has changed, and this is what will negatively impact the financial future of rural municipalities, districts and improvement areas,” Dye said. “And it will remove options in corporate Canada’s ability to meet sustainability goals.”

This isn’t a wobble in the market. Without government action the corporate procurement market won’t recover. With other provinces issuing calls for increased clean energy capacity in their provinces, developers have more options now. And some provinces are inviting or considering corporate procurement, too.

BRC-Canada is asking the government to restore confidence to the market by resolving the new risks of unnecessary red tape, regulatory charges and market complexity that it has introduced through the prolonged policy deliberations that are now hitting the 12-month-mark. Until that happens, Alberta rule changes will continue to stifle economic development in rural Alberta and unnecessarily reduce benefits to landowners and municipalities.

The 2024 municipal tax revenue of each project was calculated using the tax assessment value of that project and the mill rate from the county or municipality the project is under.

The calculation of lost tax revenue for projects that were cancelled involved deriving an assessment proxy using the latest 2023 project assessment values separately for wind and solar projects and using 2022 mill rates or very conservative mill rate estimates when needed.

A detailed explanation for lost tax revenue calculations is available upon request.

Between January 2019 and December 31, 2023, 3.26 gigawatts (GW) of renewable energy have been purchased through corporate power purchase agreements, enabling a total of 4.1 GW of project capacity. This equates to 12,400 gigawatt-hours per year of energy provided, leading to the creation of:

Check out more news, articles and blogs here