Saturday, September 28, 2024

Saturday, September 28, 2024  Saturday, September 28, 2024

Saturday, September 28, 2024

Concrete is the most ubiquitous human-made substance on earth, so it was inevitable the global inflationary spiral would come for this energy-intensive material too. Soaring cement costs and concrete shortages are a threat to US President Joe Biden’s infrastructure and manufacturing reshoring ambitions and our monetary guardians’ efforts to curtail rampant price appreciation.

Cement prices are surging on both sides of the Atlantic as producers passed on higher energy and pollution-compliance costs to customers and then kept hiking prices even as their gas and electricity bills receded. European cement prices increased by around one third last year, with some nations recording much higher increases. In the US, cement prices are increasing at a 15% annual rate; tight supplies and outright shortages have affected much of the country.

Building contractors who hoped they’d seen the back of input-cost inflation — steel and timber prices have fallen a lot lately — must instead endure another year of rising cement prices, or face going without. The world’s largest cement producers, several of which are European. can scarcely believe their luck.

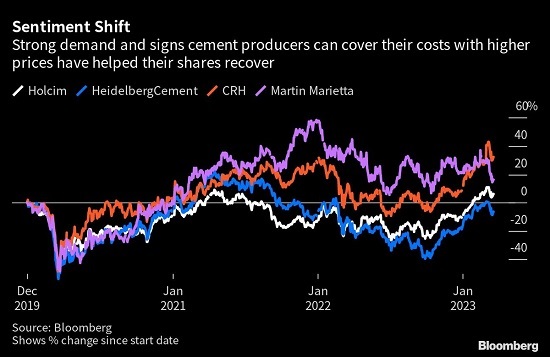

Holcim Ltd., HeidelbergCement AG, CRH Plc and Cemex SAB de CV spoke glowingly of US demand and their own pricing power in recent weeks. Holcim said several North American product categories were “sold out” and its profit margins were therefore set to hit a “very sweet spot” in 2023. Dallas-based Eagle Materials Inc. said its cement business was “near sold-out” while Midwest cement producer Summit Materials Inc. said it was seeing “tremendous pricing momentum” and was “out of capacity because we are running full out.”

After initially struggling to pass on rising energy bills to customers, price increases are now clearly outpacing input costs.

Keep reading on washingtonpost.com