Saturday, September 28, 2024

Saturday, September 28, 2024  Saturday, September 28, 2024

Saturday, September 28, 2024

China is trying to build its way out of the coronavirus slump.

Economists expect local governments across the country to issue as much as 4 trillion yuan ($565 billion) in so-called special bonds this year, roughly twice last year’s total. The proceeds are to be spent on the same type of things that China splurged on following the global financial crisis more than a decade ago — roads, airports, and railways.

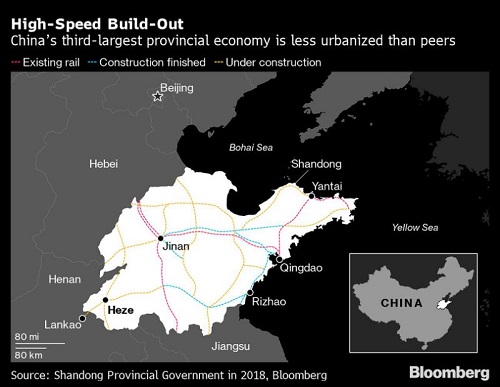

The plan is evident in the city of Heze in Shandong province, a relative backwater that’s nevertheless starting work on a connection to its first high-speed railway line.

While work paused for a few weeks amid the shutdowns, residents and officials there report that the framework of a modern bullet-train station is now rising above what were muddy fields just a few months ago.

“Construction has fully restarted and the scene is very lively and bustling these days,” said Zhang Fangzhen, a 44-year-old local entrepreneur whose house was torn down to make way for the station.

Work restarted at the construction site on Feb. 13, according to the Heze government, when the majority of China was still under lock down.

Fired on by Beijing, Heze and cities like it are pressing on with building projects of uncertain profitability with borrowed cash. The intention is that the bonds become self-financing, with project revenues sufficient to cover principal and interest over the life time of the debt.

“On the surface, debt repayments rely primarily on revenues generated by the projects themselves,” said Gloria Lu, senior director for the Asia Pacific Infrastructure Ratings team at S&P Global Ratings. In reality, “these are still government debts,” she said.

While governments around the world borrow record sums to fund stimulus aimed at curbing the impact of the coronavirus, China’s response has been modest by comparison. That’s partly due to officials’ painful experience grappling with the debts incurred following massive spending on infrastructure after 2008.

Check out the video gallery here