Sunday, September 22, 2024

Sunday, September 22, 2024  Sunday, September 22, 2024

Sunday, September 22, 2024

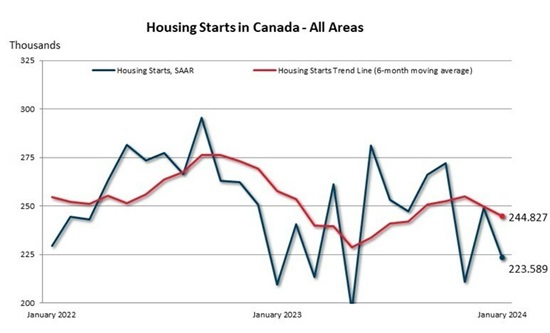

In January 2024, Canada’s housing market experienced notable shifts, as revealed in the latest report from the Canada Mortgage and Housing Corporation (CMHC). This comprehensive analysis highlights the changing dynamics of housing starts across the nation, emphasizing the trends in urban and rural areas and the variances among major cities like Toronto, Vancouver, and Montreal.

This detailed analysis provides valuable insights into Canada’s housing market as of January 2024, illustrating the complexities and regional variations that characterize the sector. Investors, developers, and policymakers can leverage this data to make informed decisions and strategies for the future. Stay tuned for more updates and in-depth analyses of the Canadian housing market trends.

Check out more news and blogs here