Monday, September 23, 2024

Monday, September 23, 2024  Monday, September 23, 2024

Monday, September 23, 2024

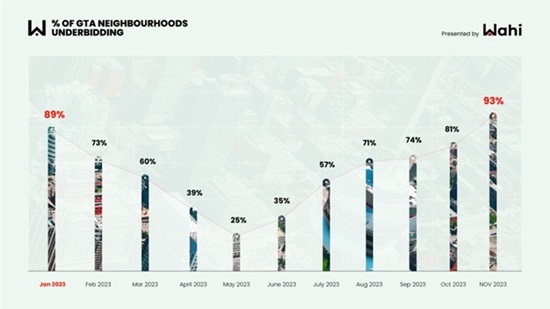

With one month remaining in 2023, underbidding activity in the Greater Toronto Area has reached its highest level of the year.

About 93% of the region’s neighbourhoods were in underbidding territory in November, up sharply from 81% in October, according to a new report from Wahi.

Every month, Wahi compares the differences between median list and sold prices to determine whether a neighbourhood is in overbidding or underbidding territory, excluding those neighbourhoods with fewer than five transactions in a given month. Based on these criteria, 256 of the GTA’s approximately 400 neighbourhoods were evaluated, with 239 in underbidding territory, one selling at-asking, and just 16 in overbidding territory. These bidding trends are an indicator of where a higher concentration of homes may be selling above or below asking.

“The effects of higher interest rates are being felt in real estate markets across Southern Ontario,” says Wahi CEO Benjy Katchen. “That said, with interest rates stabilizing, now could be a great time to potentially purchase a home due to having a greater selection of properties for sale and potentially being able to cut a sharper deal than even just a few months ago,” Katchen continues.

The share of underbidding neighbourhoods this November was also higher compared to the same time last year, when 88% of neighbourhoods were selling below asking.

Note that seasonal factors can influence bidding activity. For example, with less competition during the winter months, bidding wars may be less likely. Seller behaviour can also have an impact, such as if a home is listed below its true value in hopes of sparking a bidding war.

Wahi ranks the top five underbidding and overbidding neighbourhoods each month based on the dollar amount difference between the median list and sale prices of sold properties. This difference is referred to either as the overbid or underbid amount, depending on whether the median of all selling prices is higher or lower than the median of list prices (for sold properties only). In November, four of five top underbidding neighbourhoods were located in Halton region.

Top 5 Underbidding Neighbourhoods

| Rank | Neighbourhood, Municipality | Underbid amount | Median sold price |

| 1 | Eastlake, Oakville | $199,888 | $2,325,000 |

| 2 | Southwest Oakville | $149,000 | $2,350,000 |

| 3 | Rural Burlington | $148,000 | $2,850,000 |

| 4 | Kleinburg, Vaughan | $119,000 | $1,629,000 |

| 5 | Iroquois Ridge South, Oakville | $109,000 | $1,448,900 |

As in previous months, the top underbidding neighbourhoods have tended to skew higher in terms of median price, which makes sense. “At these prices, there is a smaller pool of buyers who qualify for financing,” Katchen explains. Conversely, the top overbidding neighbourhoods have typically been places with lower prices and, subsequently, a greater number of buyers who can bid. In November, none of the top overbidding neighbourhoods had a median price above $2 million, compared to the three top underbidding neighbourhoods that crossed into this price point.

Top 5 Overbidding Neighbourhoods

| Rank | Neighbourhood, Municipality | Overbid amount | Median sold price |

| 1 | Broadview North, Toronto | $181,000 | $1,280,000 |

| 2 | Birch Cliff, Toronto | $77,001 | $1,180,000 |

| 3 | Buttonville, Markham | $56,000 | $1,750,000 |

| 4 | North Oakville | $47,551 | $1,462,500 |

| 5 | Milliken Mills East, Toronto | $36,411 | $1,158,750 |