Monday, September 23, 2024

Monday, September 23, 2024  Monday, September 23, 2024

Monday, September 23, 2024

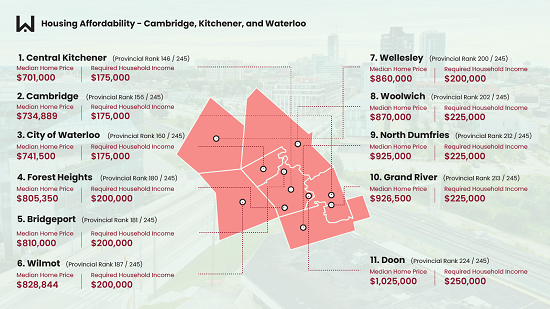

The Cambridge, Kitchener, and Waterloo area is home to one of the province’s most expensive local housing markets, according to a new report from Wahi.

The report is based on Wahi’s Roadmap to Housing Affordability: Ontario Edition, which is an interactive tool that shows homebuyers where they can potentially afford to live. Results vary depending on household earnings and local home prices in 245 local real estate markets, including about 50 cities around the province as well as many towns and villages.

According to Wahi’s calculations, Doon, a suburban community within the city of Kitchener, is the priciest in Cambridge, Kitchener, Waterloo area. It is also the 22nd most expensive in the entire province. With a median home price of $1,025,000, Doon requires households to earn a combined pre-tax income of $250,000 to afford a home. The maximum affordable monthly mortgage payments at that income level work out to $5,200.

Each local market comprises multiple neighbourhoods. For example, Doon includes Doon South and Lower Doon, while Central Kitchener — the region’s most affordable market, which boasts a median home price of $701,000 and required household income of $175,000 — encompasses the majority of the city’s more than 40 neighbourhoods, such as Cherry Hill, Westmount, and more.

To use Wahi’s Roadmap to Housing Affordability, homebuyers first enter their household income. The tool then populates a map that highlights local markets where the median home price is affordable, based on a few assumptions. Wahi assumes a 20% downpayment, a mortgage rate of 5.24% (provided by Rocket Mortgage as of July 14), and a 25-year amortization period. To meet the affordability threshold, households shouldn’t be spending more than 25% of their pre-tax income on monthly mortgage payments. Home price data is from the first quarter of this year. Median home prices include all housing types. Places where there were fewer than 50 transactions in the first three months of the year were excluded from calculations. (Note that calculations also don’t take into account savings, help from relatives, or other factors that may help a household purchase a home.)

The affordability challenges in Cambridge, Kitchener, Waterloo are not unique to the region. Provincewide, just 19 out of 245 local real estate markets are affordable for households earning the average income of about $100,000. “The fact that only a handful of cities — mostly small — are affordable to households with even above-average earnings truly highlights Ontario’s affordability crisis,” says Wahi CEO Benjy Katchen. “However, the new Roadmap to Housing Affordability also puts the spotlight on local housing markets that homebuyers might not have thought about considering before,” he adds.

Just because the median home price is unattainable at a given income level, it doesn’t mean homebuyers should give up searching. The median home price is the middle number among all transactions, meaning half of the Doon’s homes sold for less than $1,025,000, for example. Once you’ve determined your maximum budget by using the Roadmap to Housing Affordability, you can then scan Wahi listings to view properties at lower price points.

Other Roadmap to Affordability: Ontario Edition Highlights:

Curious to see which parts of the province are within your homebuying budget? Check out Wahi’s Roadmap to Housing Affordability: Ontario Edition.